How Much Gold is Allowed from Dubai to India? A Complete Guide to Customs Rules and Regulations

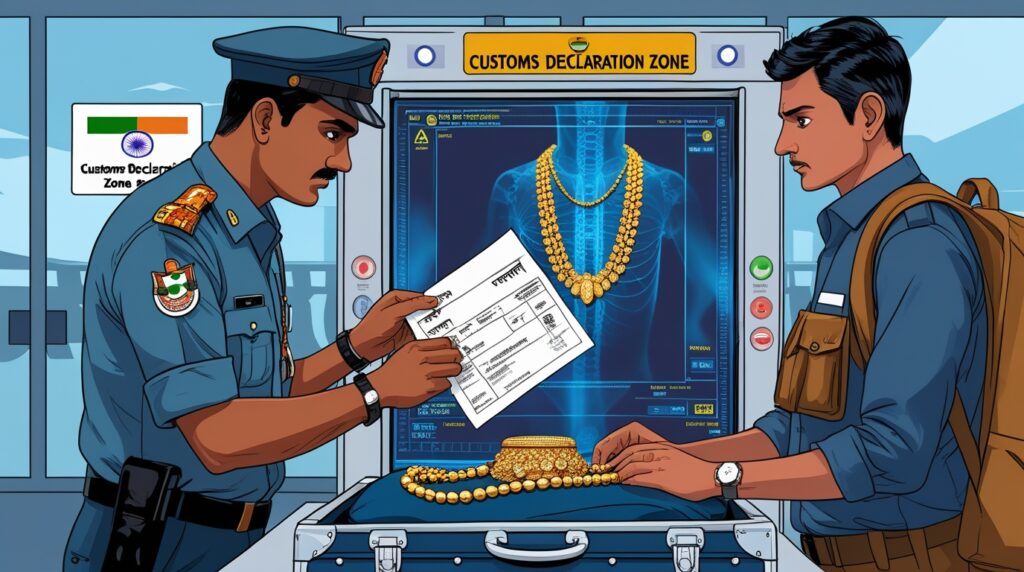

Traveling from Dubai to India often involves carrying gold, given Dubai’s reputation as a global hub for gold trading. However, Indian customs regulations strictly monitor gold imports to prevent illegal smuggling and ensure tax compliance. This comprehensive guide explains how much gold you can legally carry from Dubai to India, duty-free limits, customs duties, penalties for violations, and tips for hassle-free travel.

1. Why Dubai is a Popular Source for Gold

Dubai’s tax-free policies, competitive pricing, and wide variety of jewelry designs make it a preferred destination for purchasing gold. Non-Resident Indians (NRIs) and tourists often buy gold in Dubai due to its purity (24K) and trust in certifications like the Dubai Good Delivery (DGD) standard.

2. Indian Customs Regulations on Gold Import

India’s Central Board of Indirect Taxes and Customs (CBIC) sets strict limits on gold imports to control smuggling and protect the economy.

A. Duty-Free Gold Allowance

- For Male Travelers: Up to 20 grams of gold jewelry, valued at ₹50,000 or less.

- For Female Travelers: Up to 40 grams of gold jewelry, valued at ₹100,000 or less.

- Conditions: The gold must be for personal use, declared in the Baggage Declaration Form, and carried as baggage.

B. Duty on Excess Gold

Gold exceeding the duty-free limit attracts a 12.5% customs duty plus a 3% Goods and Services Tax (GST). For example:

- Excess gold value: ₹5,00,000

- Total duty: ₹5,00,000 × (12.5% + 3%) = ₹77,500

Note: Gold coins/bars are not eligible for duty-free allowances and are taxed at full rates.

3. Prohibited and Restricted Gold Items

- Banned: Gold in primary forms like raw ore, nuggets, or semi-processed bars.

- Restricted: Coins/bars require proper invoices and payment proofs.

4. Penalties for Violating Gold Import Rules

- Confiscation: Undeclared gold is seized by customs.

- Fines: Up to 200% of the gold’s value + pending duties.

- Legal Action: Criminal charges under the Customs Act, 1962.

5. Tips for Legally Carrying Gold from Dubai to India

- Declare All Gold: Submit a Baggage Declaration Form (BDF) upon arrival.

- Keep Original Invoices: Ensure invoices mention weight, purity, and cost.

- Avoid Carrying Coins/Bars: Opt for jewelry to utilize duty-free limits.

- Use Authorized Dealers: Buy from DMCC-certified sellers in Dubai.

6. Recent Changes in Gold Import Policies (2023–2024)

- Increased Scrutiny: Enhanced X-ray checks and AI-powered scanners at Indian airports.

- Digital Payments: Only gold purchased via traceable methods (cards/bank transfers) is accepted.

7. FAQs on Gold Carriage from Dubai to India

Q1. Can I carry gold for weddings without duty?

A: No. Wedding-specific exemptions were removed in 2020. All gold beyond limits is taxed.

Q2. What if my inherited gold exceeds the limit?

A: Submit inheritance proof and pay applicable duties.

Q3. Is there a limit on gold carried by minors?

A: Minors have no separate allowance; their gold counts toward parents’ limits.

8. Case Study: A Tourist’s Experience

Rajesh, an NRI, carried 35 grams of gold jewelry to Mumbai. He declared it, paid ₹18,000 duty on the excess 15 grams, and avoided penalties.

9. How to Calculate Custom Duty on Gold

Use this formula:

Duty = (Gold Value − Duty-Free Value) × (12.5% + 3%)

Example:

- Total gold: 60 grams (₹2,00,000)

- Duty-free: 40 grams (₹1,00,000)

- Taxable value: ₹1,00,000

- Duty: ₹1,00,000 × 15.5% = ₹15,500

10. Conclusion

Understanding India’s gold import rules is crucial to avoid penalties. Stick to duty-free limits, declare your gold, and retain purchase proofs. For frequent travelers, exploring India-UAE bilateral trade agreements or seeking RBI approvals for large imports may be beneficial.

Gold allowance from Dubai to India, Indian customs gold rules, Dubai gold import duty, legal gold limit to India, carrying gold jewelry to India.